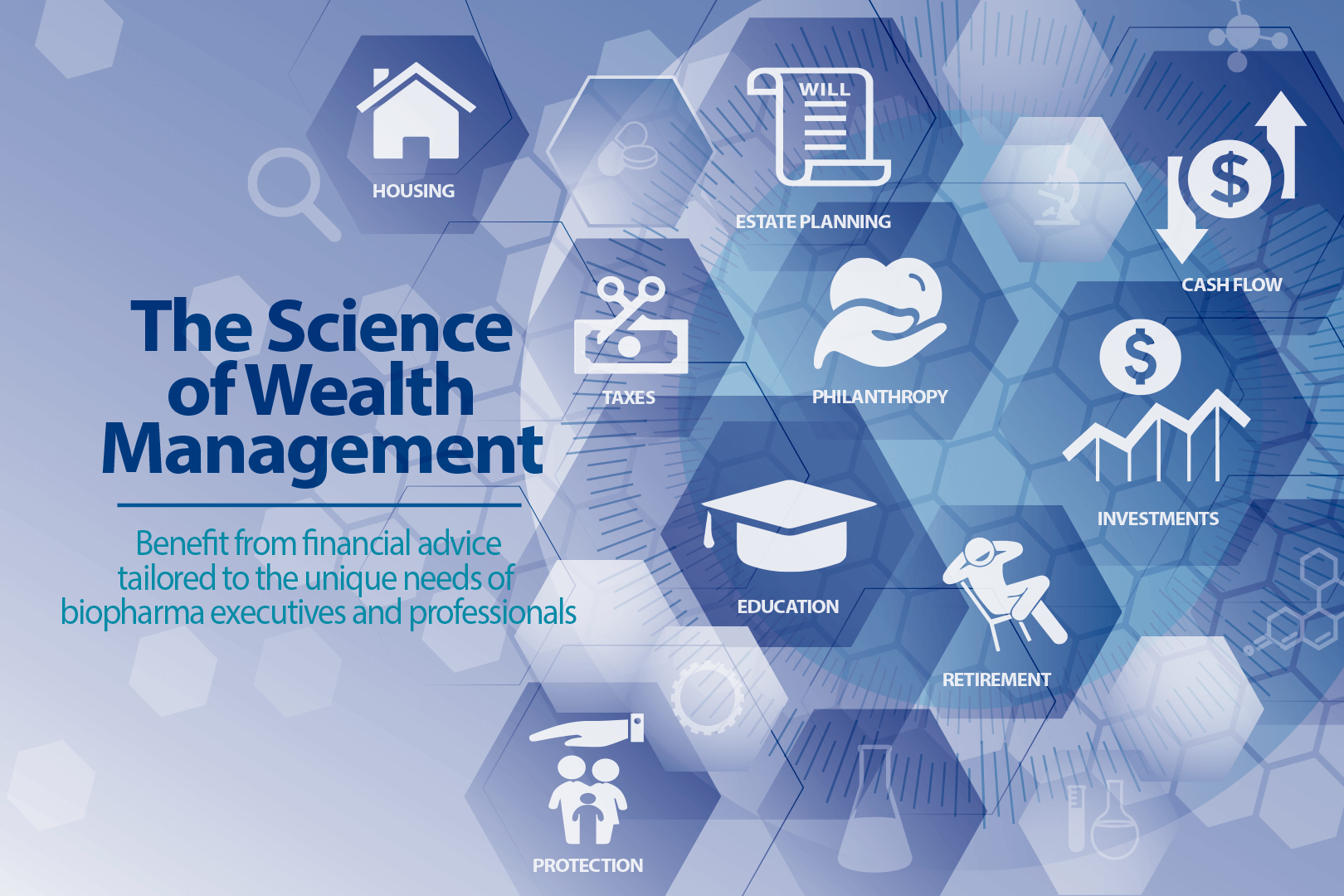

Science of Wealth

Click the icons below for more information

Cash Flow

Cash Flow

All planning starts with cash flow. We look at money in vs money out to strategically customize your cash flow to the priorities you lay out for us.

Education

Education

Trying to help your children or grandchildren with education costs? Saving for college has never been more important. Inflation in education has been growing at about 8% annually. The earlier you start saving, the easier it will be to help. You can get tax free growth along with tax free distributions, as long as the money is being used for qualified education expenses. It’s a win-win.

Estate Planning

Estate Planning

We look at what legacy you want to leave and to whom. We use that information to build an appropriate plan based on current legislation to try to maximize the gift size. Estate planning encompasses Wills, Power of Attorney, Trusts, and Philanthropy.

Housing

Housing

The home is usually the single largest investment most families will make in their lifetime. Most banks will tell you to purchase a home at your absolute highest affordable limit with a 20% down payment. Is that the smartest choice? Maybe or maybe not. We will work through multiple choices with you to choose the right house at the right price while understanding what other goals you have in mind.

Investments

Investments

Building the proper portfolio based on you and your family’s goals within a set parameters of risk tolerance.

Philanthropy

Philanthropy

Charitable giving has become a vital part of affluent families. You can count on us to walk you through your choices and understand there is more to giving than simply writing a check.

We can help with in-kind donations, qualified minimum distribution donation, or setting up foundations.

Protection

Protection

Using insurance to protect families through major life events giving you confidence they will be cared for.

Retirement

Retirement

All the way from asset gathering through asset disbursement, we are here to help you understand your options and the effects those decisions will have on your short and long term plans.

Taxes

Taxes

Using tax specialists to analyze and arrange your family's financial situation in order to try to maximize tax breaks or minimize tax liabilities, where possible, in a legal and efficient manner. *